Returns … too have a variety? Yes … Any investment that you make or if it promises a return talks about only “Total Returns” or “Nominal Returns”. But these are not “Returns in Hand”. Let’s check the difference between Nominal Returns Vs Real Returns.

As the total returns have components and when adjusted with these then only you get “Real Returns”. If you are salaried it is similar to the concept of CTC. CTC has component and deductions like EPF or Income Tax. Your “Net Take Home” is different from Monthly CTC.

If you are a businessman, your earnings are subject to Income Taxes or expenditures that you incur to generate business. So there is a difference between Gross Proft & Net Profit after Expense & Taxes.

Update: 02 June 2019 : Do you know India is the second most positive real rate return country? Check these figures dated May 2019.

So what is this concept of Nominal Returns Vs Real Returns ?

Some say that Real Returns are superior to Nominal returns. Is it so? Is Nominal Returns concept a lie?

Let’s find out!

Different return measures provide information about different things. It is not, as some suggest, that one is inherently superior to another.

Rather, they measure different things, provide a different context, and are appropriate in different circumstances.

When we talk about Nominal Returns & Real Returns, Nominal Returns are what an investment generates before taxes, fees, and inflation.

It is simply the net change in price over time.

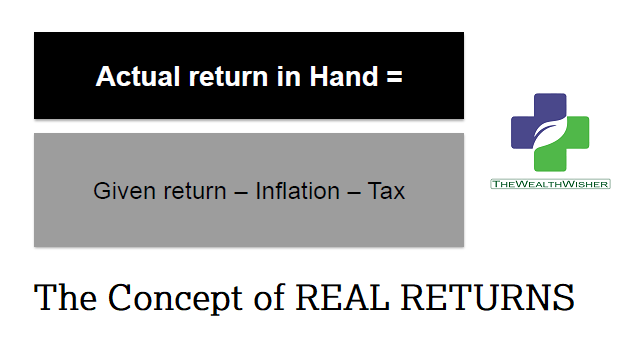

Whereas Real Returns are the actual value of your returns, typically after adjusting for inflation, income tax, and fees.

Real Return = Nominal Return – (Rate of Inflation + Fees & Cost + Taxes)

Inflation

The general rule in economics is that the value of money today will not be equal to the same amount of money in the future. Also known as the time value of money, this is a central concept in finance theory, which takes into account factors such as interest rates and inflation.

When calculating returns over time, it is important to keep this in perspective and know the difference between normal returns (returns on paper) and real returns (adjusted for today’s purchasing power) differ.

Can you beat inflation?

Certainly. But putting your money in a Fixed Deposit is not the way to go about it. To fight inflation, the key is to invest in a product which gives you a higher rate of interest than inflation and ultimately leaves you with a surplus to meet your goals.

If not, you will find that the value of your investment has actually reduced! Shocked? Let’s see why this happens.

For example : Let’s say your bank pays you interest of 4% per year on the funds in your savings account. If the inflation rate is currently 4% per year, then the real return on your savings today would be 0%.

In other words, even though the nominal rate of return on your savings is 4%, the real rate of return is NIL, which means that the real value of your savings did not increase during a one-year period.

What about Taxation?

If you take into account the tax implications, the real return will be even lower. Hence, assuming that the stated return is 9 percent at an inflation rate of 4 percent, translating into a real rate of 5 percent, a 30 percent tax on 9 percent interest income would knock off 2.7 percent, which is the real return. That doesn’t sound as good, does it?

Nominal Returns vs Real Returns in Bank FD

Nominal FD Returns 9%

Inflation 4%

Tax 30%

Real Return = Nominal Return – (Rate of Inflation + Fees & Cost + Taxes)

Real Returns = 9% minus (4% + (30% of 9))

Real Returns = 9% – (4% + 2.7%)

Real Returns = 2.3%

Want Another Example?

Nominal Returns vs Real Returns in Equity Mutual Funds

Nominal Returns 12%

Inflation 4%

Tax 10% (Assuming the money is taken out after one year, making ot a long term capital gain)

Real Return = Nominal Return – (Rate of Inflation + Fees & Cost + Taxes)

Real Returns = 12% minus (4% + (10% of 12))

Real Returns = 12% – (4% + 1.2%)

Real Returns = 6.8%

Can YOU increase Real Returns?

Yes to some extent.

You CANNOT CONTROL INFLATION.

But you can increase returns by choosing products or schemes. This does not mean you simply start trading in equity. This should be a right balance as per your Risk Taking Ability & time horizon of the goal for which you are investing. I am talking about asset allocation here.

Also, you can increase returns by choosing products or schemes which charge less (or no tax) in Taxes & Fees. So a decrease in expenses can increase Real Returns.

Again caution here – Taxes in equity compared to Debt may seem less but you have to take care of asset allocation. Many times, investor have been duped or missold ULIPs or balanced funds in form of Fixed Deposits.

So the next time you have money to invest, keep in mind the Concept of

Nominal Returns Vs Real Returns, and not the advertised returns.

Thus, as per your risk appetite, you might consider investments such as equities, Equity Mutual Funds or Debt Mutual Funds which historically have been relatively insured from inflation, as compared to FDs. The distinction between nominal returns vs real returns will help you increase overall returns.