In 2009, when teaser loans were the rage, Suhas and Namrata Joshi, a young couple from Pune, India took a teaser loan from a public sector bank at a very attractive rate of 7.5% p.a. Like most teaser loans, for the next two years the rate rose by a percentage and then after the third year in 2012 the rate changed from fixed to floating and the Joshis were paying a floating interest rate of 12.5% p.a. as decided by the bank.

This was while the same bank was charging its new customers a floating rate of 10%. With a rate difference of 2.5% p.a. between an old borrower and new borrower, it became inviting to the Joshis to try to benefit from the new borrower rate via a home loan transfer.

What is a home loan transfer ?

Home loan transfer is basically taking a home loan from a new lender to pay off existing home loan. All future payments are made to the new lender. Typically, the choice to transfer is made when your lender has not reduced the home loan rate (if a floating loan) to move in tandem with the prevailing market rates.

Home loan transfer or balance transfer of your home loan usually occurs when the loan has been taken a few years back and the current rates are lower. Most lenders do not pass on full benefit of falling rates to existing borrowers but offer lower rates to new borrowers. Home loan transfers have become more attractive in the last few months since Reserve Bank of India (RBI) and National Housing Bank (NHB) have asked lenders to stop charging a prepayment penalty on housing loan. This means, if you are prepaying your old loan, you will not be hit with a hefty penalty and thus the cost of home loan transfer does not rise.

This is also commonly referred to as home loan refinancing.

Should I opt for a home loan transfer?

You should go for home loan transfer if:

- You want to reduce your interest rate and lower your EMI payments.

- You wish to reduce your home loan term and want to pay off your loan faster.

- You want to use the equity in your house to get money for any of your needs. You can take a top-up over the existing loan.

The first two make more sense as a reason for investors to opt for switching to a new home loan. If your reason is the third, you might want to ensure that you do not take on too much debt via the top up feature just because you own a house – well technically, you still do not own it as the property is mortgaged.

Cost-benefit analysis when you do a home loan transfer

While all the reasons to transfer sound very attractive, home loan transfer is not always the best solution even if the initial rate difference looks attractive. There are several other costs involved which must be taken into account before deciding to make the switch. As mentioned before, the lender is not supposed to charge a pre payment penalty, however there are some lenders who still charge a penalty and they need to be reminded about the RBI dictum.

There is a processing fee charged by the new lender for all the new paperwork that it has to do. This is calculated as a percentage of outstanding loan amount. It could vary from 0.25% upto 1% for a salaried person and even upto 1.5% for a self employed person. There might also be some other charges by the old or new lender. Do check thoroughly before proceeding. The bottom line is – switch only if you are saving substantially.

If you plan to switch, you must, to begin with, estimate your net savings over the entire tenure of the loan. In simple terms, it would be savings on interest outgo minus processing fee paid to the new lender as well as the prepayment penalty.

Let us again take the examples of the Suhas and Namrata Joshi.

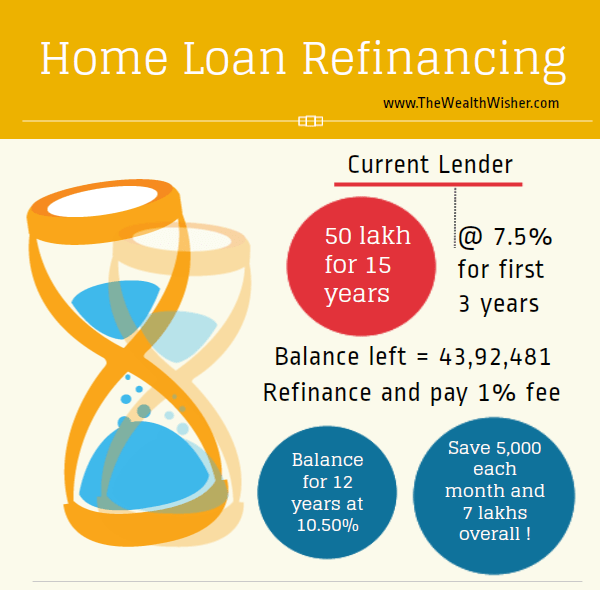

They have a Rs 50 lac loan for 15 years. After the three years of interest rate at 7.5%, they decide to switch and at that time their home loan outstanding balance was Rs. 43,92,481. If they continue with their current lender at 12.5% p.a. they will pay an EMI of Rs 59,029 each month and a total outgoing for the remaining years will be 85,00,129.

However if they switch to a new lender the rate will change to 10.50 %p.a. for the next 12 years, they will pay an EMI of Rs 53,770 and a total amount of Rs. 77,42,901.

The amount saved = Total outgoing with old loan- (total outgoing with new loan + processing fee of 1% on new loan amount)

Amount saved = 85,00,129 – (77,42,901+43,924) = Rs. 7,13,304

A saving of over Rs. 7 lacs is substantial enough to consider taking a home loan transfer in this case. However if the rate difference was lesser or there were some other charges, then there would little or no benefit from switching lenders.

Must know:

- Before considering a transfer of you home loan, approach your original lending bank to negotiate the rate lower. If they offer a competitive rate then it makes sense to continue as it avoids a lot paperwork and hassle.

- Home loan transfers work best when interest rates are falling.

- Look for a balance transfer only if you have many years of repayment ahead. If most of your loan is paid, balance transfer will offer little financial benefit.

Though the teaser home loans have now been withdrawn, investors might still find themselves stuck with home loans with higher interest rates depending on the movement of interest rates with time – this strategy of home refinancing still hold good in such cases.

Thanks! This is very useful information. I have been reading articles from TheWealthWisher blog from long time and love to read the way you guys write. Thanks for such a useful information.

Thanks Abhay, keep coming here for more.

Hi,

I have a axis bank loan @ 11.25% . Atleast verbally bank confirmed that at the time of taking loan said that the pre-payment can be done without charges but the source of funds should be your own money and not home loan transfer. I wanted to know

a) Has anyone done a home loan transfer from axis bank to any other bank without paying any pre-payment penalty.

b) How in the world bank would come to know the source of funds and do they have the right to know the same? Techinically, home loan transfer is a two step process where you foreclose the loan with old bank and take a new loan with new bank. Am I correct in my thinking

I think they have the right to know this. They are taking a written declaration from you so YOU are their source of information. I recommend that you stick to the truth and do not play around on this as later it come come back to haunt you.