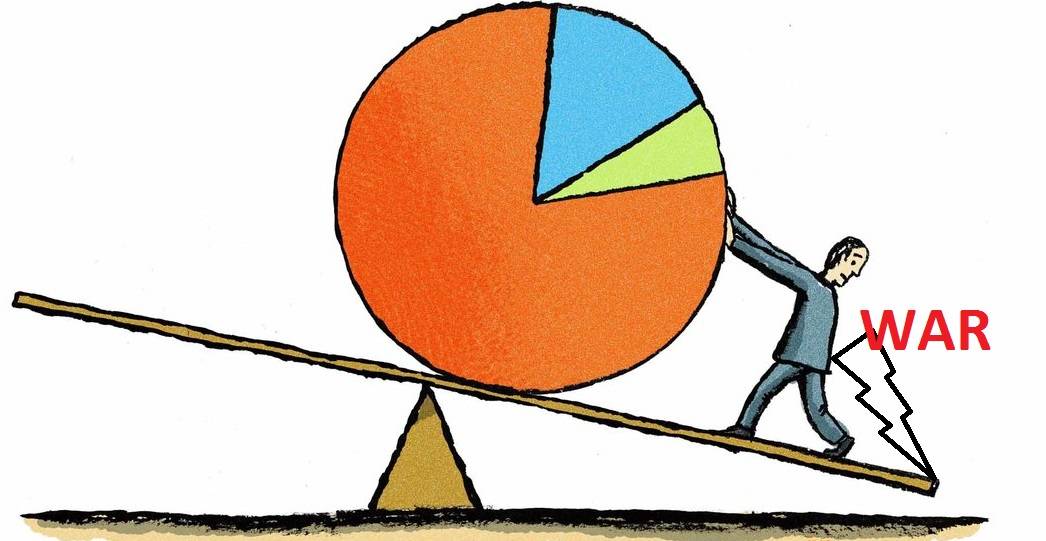

Our ex-PM, Sh Atal Bihari Vajpayee had once quoted “You can change History, but not Geography”. It’s your luck what kind of neighbors you get. Unfortunately, our northwest border has always been under fear of aggression by our neighbor, whom we gave birth in 1947. The shadows of war or a limited attack are again looming and hence markets and your investments would be disturbed during this period.

There is a saying (shloka) in Sanskrit, Om Sarve Bhavantu Sukhinah | Sarve Santu Nir-Aamayaah | meaning- Let ALL be happy, may ALL be free from illness. The first line is so important as happiness in relationships, with neighbors is very important. If they are disturbed, it will disrupt us. Hence world peace is advocated by our Vedas. But let’s face it- we have a neighbor whose army has been a group of irresponsible brats and political system is highly corrupt. A response is awaited or rather a hostile aggressive warfare is awaited.

Markets took a dive on the first day of crisis and will be volatile. As an investor what should you be doing? Well, let me tell you, this is not the first time. Geopolitical issues of greater magnitude have lived but markets have survived. The latest event was Brexit when jitters happened throughout the world but time stabilized everything. Important is not to lose faith in the Assets you have invested.

me tell you, this is not the first time. Geopolitical issues of greater magnitude have lived but markets have survived. The latest event was Brexit when jitters happened throughout the world but time stabilized everything. Important is not to lose faith in the Assets you have invested.

This is the time when markets will be very sensitive, especially ours as we have a lot at stake. Be ready to face volatile times which means prices are going to go up and down in short span. An investor should do following things:

- Do not stop your monthly investments: This is the time when you will be engulfed in fear and you may be told to stop your SIPs and monthly investments. Please refuse to do so.

Like any other crisis, this is the time to accumulate more assets/shares/units. The prices will go down, hence you will get more especially in mutual fund SIPs and STPs. When you started these SIPs, you had a long-term vision and you knew markets will go cyclical. War is one of the reasons but markets are reacting how they should in short run. HENCE DO NOT PANIC.

Like any other crisis, this is the time to accumulate more assets/shares/units. The prices will go down, hence you will get more especially in mutual fund SIPs and STPs. When you started these SIPs, you had a long-term vision and you knew markets will go cyclical. War is one of the reasons but markets are reacting how they should in short run. HENCE DO NOT PANIC.

- Do not liquidate: Your brokers will specially give you this advice as they get the opportunity to reinvest and make brokerage. This is like starting to run when the marathon is half way. Sit tight and believe in what you have invested. Liquidating means timing the market and again trying to find a right market to invest. Research studies show that the decisions investors make about when to buy and sell funds cause those funds to perform worse than they would have had the investors simply bought and held the same funds.

Avoid Greed & Leverage:You will be sold ideas and opportunities to make a kill in short run. Market pundits will have views and will try to sell them to you. The best way to make money in volatile times is not to participate. Let things stabilize a bit. Attempting to move in and out of the market can be costly. Also, do not get funds on interest and build a position on derivatives. This is basically multiplying the problem. Leveraged funds or buying more than the net worth will be the worst danger you can put yourself into.

Avoid Greed & Leverage:You will be sold ideas and opportunities to make a kill in short run. Market pundits will have views and will try to sell them to you. The best way to make money in volatile times is not to participate. Let things stabilize a bit. Attempting to move in and out of the market can be costly. Also, do not get funds on interest and build a position on derivatives. This is basically multiplying the problem. Leveraged funds or buying more than the net worth will be the worst danger you can put yourself into.

- Be prepared – Mentally: It’s better you develop your mind and your perspective that things will be volatile and you may lose a bit of valuation on your portfolio. Market downturns may be upsetting, but history shows that the stock market has been able to recover from declines and can still provide investors with positive long-term returns. In fact, over the past 35 years, the market has experienced an average drop of 14% from high to low during each year but still had a positive annual return more than 80% of the time.

- Believe in assets you have invested: If you are nervous when the market goes down, you may not be in the right investments. Your time horizon, goals, and tolerance for risk are key factors in helping to ensure that you have an investment strategy that works for you. Even if your time horizon is long enough to warrant an aggressive portfolio, you have to be comfortable with the short-term ups and downs you’ll encounter. If watching your balances fluctuate is too nerve-racking for you, think about reevaluating your investment mix to find one that feels right.

- Follow the Mantra of Value Investing: Just watch out 2 things. Are you properly diversified? Is your asset allocation optimum? Although in a war like scenario, diversification will not help much but still you should aim for it. Investing in debt or say international securities can help you earn or hedge portfolio to a good extent. Similarly reviewing your asset allocation saves you from the risk associated with a concentrated

These are just a few of the things that I have seen successful investors do that unsuccessful investors don’t do. They are simple yet effective. These are testing times ahead and we all will be thrilled with the hap pening on the border. As one of my friends messaged –

pening on the border. As one of my friends messaged –

Portfolio down by 10% but Patriotism up by 200%!

Same here friends! Do share your views below and your strategies during volatile times.