We did an article earlier which talked about questions to ask your financial planner. I hope you folks have read it, if not, now is the time to go and check what it was all about.

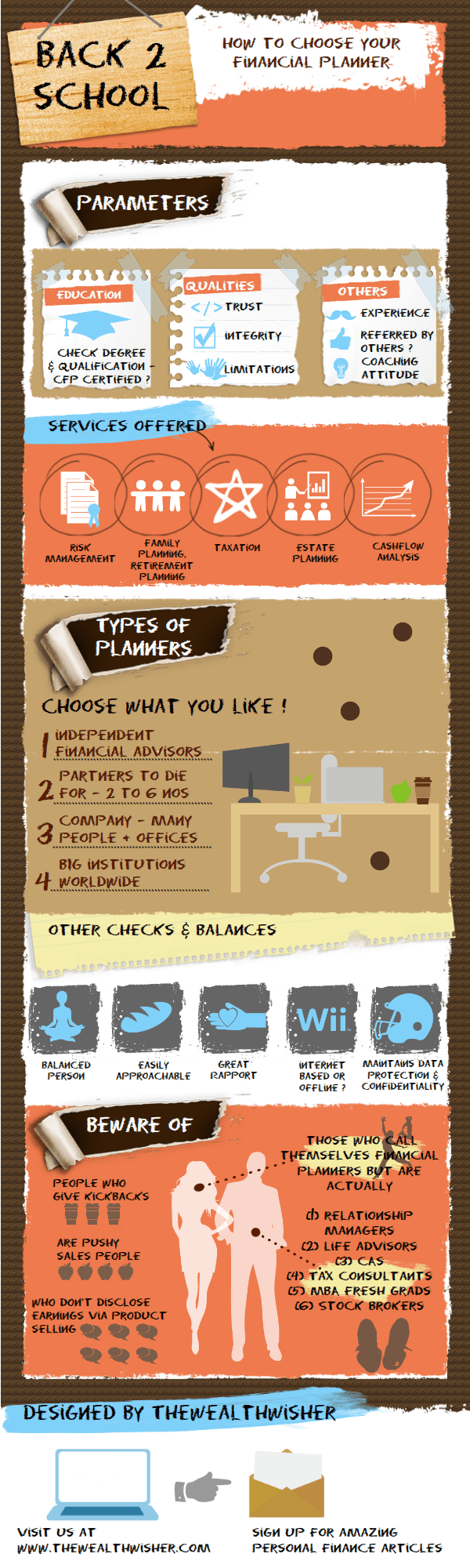

In this article today, I have tried to capture the same things in an infographic. I have run through the parameters you need to keep in mind when choosing your financial planner, checking whether he is certified or not and assessing whether he has integrity, professionalism and any limitations – a person is humble when he says upfront what he CANNOT do !

I have also tried to document 4 types of planners and hope you will have some questions around them and which one to go to, so why don’t you go through the graphic and use the comments section to clarif y your doubts.

And don’t forget to spread this beautiful infographic if you like it !

Excellent presentation.

Thanks Soubhagya, appreciate your reply.

Excellent infographic. I think CFPs need to coin a new phrase for what they are offering. The term financial planning is being abused by insurance companies and advisors and bank relationship managers.

A question asked my cousin recently who spoke to a HDFC advisor:

if they guys can calculate how much is need to save for each goal and offered specialized products for these why should I go to a CFP?

I did my best to explain but he was not convinced.

Thanks Pattu. Ask your cousin to call me 🙂

The new Investment Advisor Regulations will streamline everything hopefully.

How is your financial initiative going on ?

Its slowly gathering steam. facebook id: freefincal

Thanks

Hey Overall a good info-graphic here.. Well one thing I want to ask you is..!

Are CAs are not Financial Planners ? I mean, They are not able to ? because you stated that, Those who call themselves Financial Planners might be, CAs and Etc. Etc.

Can you please throw some lights on?

No, CAs are not financial planners.

A CA does accounting and taxation for companies and individuals. He does not do holistic financial planning. SO he does not string together retirement planning, insurance planning, investment planning and tax planning TOGETHER. He might do them in silos which is not a good thing to do.

Same is the case with relationship managers, life insurnace agents, stock brokers.

Now this does not mean that there are no CAs offering such planning services – there might be many but you need to differentiate that.

Primarily, CAs do not offer comprehensive planning services.

OK..! Thanks for this reply..! 🙂

Amazing stuff, looks like a lot of effort went into it.

Good ready reckoner for people who want to seek financial help.

Thank you sir !

Is a CFP degree enough for financial planner? what about the track record paradox since planning is long term process how do i know if the CFP is good,

How do I trust a CFP which can be passed in less than one month study by any average level B Com student?

How do i differentiate between Good CFP & BAD CFP.

Like with everything in life, you certainly need to check the track record. No one is forcing you to trust a CFP outright. It is your inexpressibility to check for testimonials, talks to other customers, grill the planner and then take the final assessment.

I however disagree with your comment around “average B com student”. Every degree, be it Bcom or CFP is honorable and needs to be looked at with the highest respect.

What are your thoughts on how you would differentiate ?

Hi,

I did not mean to demean the degree, i just meant that the entry bar is too easy, & when entry bar is too easy you will have non desirable elements coming in, Now the problem is CFP giving me a life chart & long term & sh0rt are subjective concepts. But testing the planner on the other hand is different ballgame & requires high level knowledge of personal finance, so if I have the knowledge to grill a CFP, I actually do not need a CFP. That is the Track Record Paradox I am talking about. Frankly I am unable to answer that & this is the question which is troubling most of the Clients so………………

That is a problem that exists in every field and not just CFP. The investor has to become smart. Also, if you have the knowledge to grill a CFP, you might still require one.

At the end of the day, the onus is on the investor to be aware of what he is getting into. CFPs are bound by code of ethics which makes in mandatory for them to disclose everything and be honest with their practice.