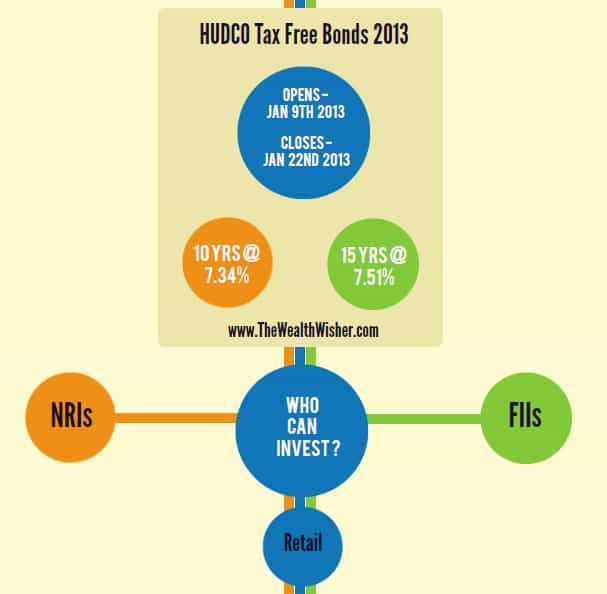

Housing and Urban Development Corporation Limited HUDCO Tax Free bonds for 2013 are out in the market. The issue opened on Jan 9th 2013 and will end on Jan 22nd 2013.

There have been 4 tax free bond issues in the recent past and all of them have been popular with investors.

Details on HUDCO Tax free bonds for 2013

The total value of the bonds amount to Rs 750 crores and 40% of the issue is meant for retail investors.

There are two versions of the tax free bonds that are available.

The one for 10 years has a coupon rate of 7.34% and the one for 15 years has a coupon rate of 7.51%. For retail investors, there is an extra 0.50%. The minimum investment that a retail investor needs to make is Rs 5,000.

| Specifics | ||

| Series 1 | Series 2 | |

| Tenure | 10 yrs | 15 yrs |

| Coupon rate | 7.34% | 7.51% |

| Minimum Investment Amount | Rs 5,000 | Rs 5,000 |

| Face Value | Rs 1,000 | Rs 1,000 |

After purchasing these from the primary market, these can still be traded on the secondary market. Though you can buy them both in physical and DEMAT form, if you wish to sell after listing then you need a DEMAT account.

HUDCO Tax free bonds have been rated at AA+ which is lower than the similar issues that have come out from IIFL, RFC and PFC. Read the IIFL tax free bonds 2013 issue here.

Should you buy HUDCO tax free bonds for 2013 ?

A point to note here is that future tax free bonds that come out in the market will have a lower rate of interest as these bonds are bench marked against Government securities – G-Sec, the interests rate of which is expected to go down in the future. So if you haven’t latched onto the earlier ones and you need one now, this is your best bet. Needless to say, whether you need to have HUDCO tax free bonds in your portfolio is a decision you need to make in alignment with your goal based investing. Please get in touch with your investment advisor if you think you cannot make the decision yourself.

Apart from retail investors, Non-Resident Indians (NRI) and Foreign Institutional Investors (FII) can buy these bonds. From what I understand, for these two categories, it becomes a nice investment avenue as compared to say gilts and other corporate bonds because there the interest earned is taxable whereas the interest earned from these tax free bonds is not taxable.

Also note that you ideally should not be selling these bonds after listing. That is because once you do that, you will be liable for capital gains depending on your holding period. Paying tax will only reduce your total outgo so it does not make sense to get lower than what a lower returns these bonds are offering.

As mentioned in my review of IIFCL tax free bonds, it makes sense for retail investors in the highest tax bracket to buy these if your situation demands so. So instead of investing in a fixed deposit, you will be better off investing in these tax free bonds.

Make sure you make the right decision. I will do another article comparing these and fixed deposits (FDs).

Lastly, if you want to hop over to the official website to check on HUDCO tax free bonds HUDCO, do so here.

Hi,

I’m exhausted with section 80C and want to invest in bonds which will give some more tax exemption but when I see everywhere all the bonds are issued in the month of January and closes very fast. Is there any possible way to get the bonds in this FY? If I have to get updates on Tax free bonds or infrastructure bonds where I have to register myself? Please let me know.

Thank you

Kishore B

@Kishore,

You won’t get any additional benefits apart from 80C if you invest in tax free bonds.

Infrastructure bonds have been discontinued since last year.

Thank you for the information. Could you please let me know how would I know about the bond issue dates? Is there any notification alert I can get?

@Kishore,

Usually any new Govt bonds to be listed will be published in leading newspapers. Also you can check the same on financial websites namely valueresearchonline and moneycontrol