Yesterday Reserve Bank of India Monetary Policy Committee reduced the Repo Rate by 25 basis points. This is a huge trigger for home loans and other consumer loans. This Diwali will be full of offers. The major beneficiaries will be Banks, NBFCs, and Mutual Funds, especially the debt funds. Debt Funds & RBI Monetary Policy are two interlinked topics in MF industry. Let’s check Impact of RBI Monetary Policy on Debt Funds.

Let’s try to understand the Impact of RBI Monetary Policy on Debt Funds

Debt Funds returns are calculated as:

Debt fund returns = Net YTM on the portfolio +/- capital gains (or losses)

One of the reasons that Debt Funds can make capital gain is if the Rate is Cut. In simple words, when rates are cut the existing bonds/debt papers become costly as demand for them increases. The fund managers would rush to get old securities as new securities will give fewer returns.

There is a relationship between the interest rates in the economy and the prices of bonds. We also know that the prices of bonds are more sensitive if the bond maturity is long as compared to short maturity bonds.

As the bond prices move, the NAV of the fund would move in the same way.

How to use Debt Funds in your portfolio?

Debt funds should be invested based on a lot of factors. But initial reasons should be:

- Asset Allocation in the overall portfolio

- Risk Return levels of the investor.

- Time horizon.

Asset Allocation is the basic reason why debt fund is included in the portfolio. Recently Valueresearch studied this and found that best portfolio in terms of returns is achieved when debt is somewhere between 40-60%.

Yes, the portfolio with 100% equity gave fewer returns that the portfolio with Equity & Debt combination.

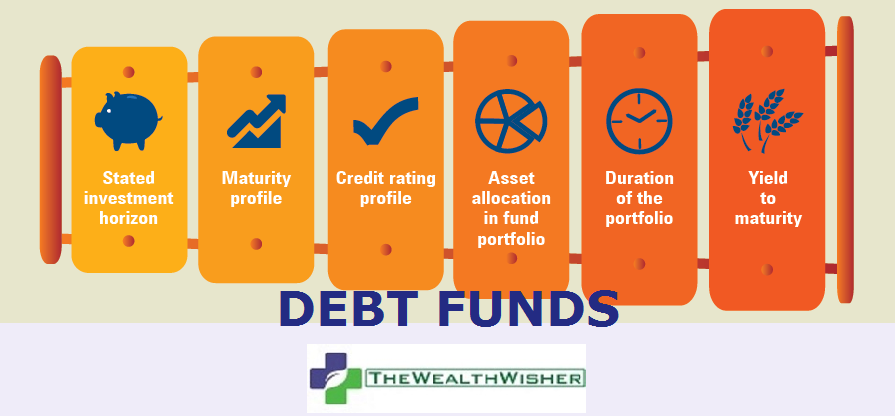

Let’s revisit the basics by learning debt fund through some images.

During the time when equities are making abnormal returns, one should never forget the asset allocation.

Share the article on Impact of RBI Monetary Policy on Debt Funds. You may share your views in the comments section below.