Oliver Gingold, who worked at Dow Jones, coined the phrase ‘Blue Chip’ in 1923. This term came into vogue after Gingold, while standing near the stock ticker at a brokerage firm, noticed that several stocks traded at $200 or more per share. He called them ‘Blue Chip Stocks’ and wrote an article on them. That’s how the phrase was born.

The blue chips generally sell high-quality, widely accepted products and services. These companies are known to weather downturns and operate profitably in the face of adverse economic conditions, which helps to contribute to their long record of stable and reliable growth.

“Blue Chip Companies” are the companies that have stable earnings and do not have extensive liabilities. The stocks of these blue chip companies, referred to as ‘blue chip stocks’, pay regular dividends even during the bad time of the organization. When a company can distribute dividends even in bad times, it shows how confident they are about their cash inflows.

These stocks possess some sort of major competitive advantage that makes it extraordinarily difficult to unseat market share from them, which can come in the form of a cost advantage (Hero) achieved through economies of scale (Unilever), a franchise value (Maruti) in the mind of the consumer, or ownership of strategically important assets such as vast capital investment (Reliance Jio), Unmatched Brands (Tata) or technology (Apple).

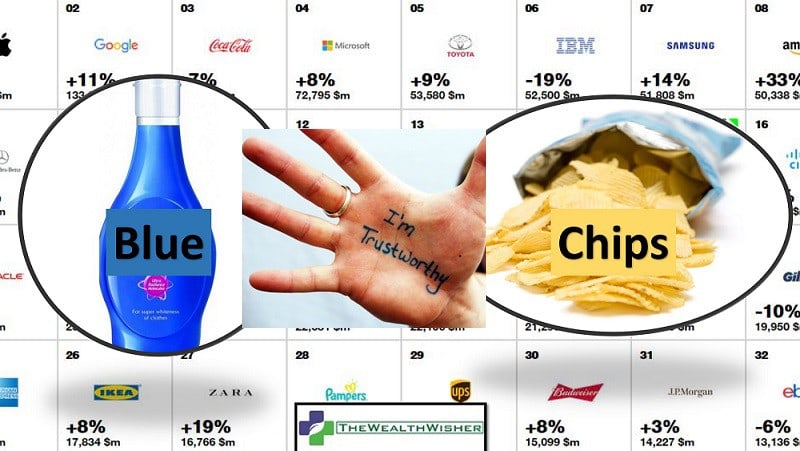

Here is an Infographic to learn about Blue Chip Stocks:

Hope you now understand why Blue Chip Stocks are market favorites. These are like gold assets… whenever there is turmoil, market players run to secure blue chips.

That is why any financial planner or wealth manager cannot over look them in portfolio comprising equity investments.

Hope your like the infographic and the information provided. Do share your views in the comment section below.

Also, share the post so that it helps reach who need to read and understand Blue Chips Stocks.